The Fear of Market Crashes:

Imagine this—you start your Systematic Investment Plan (SIP) with the goal of long-term wealth creation. But then, the stock market crashes and your portfolio turns red.

Fear kicks in. “Should I stop my SIP?”

If this thought has crossed your mind, you’re not alone. Many investors panic and pause their SIPs during market downturns. But what if I told you that SIPs work best in falling markets?

Let’s explore a real-life example that proves why staying invested through market crashes is the smartest move for long-term wealth creation.

The Dot-Com Bubble: A Market Crash That Made Investors Millions

Meet Ravi and Sameer—two investors who started their SIPs around the dot-com bubble burst, one of India’s worst stock market crashes.

📉 February 2000: Ravi started his ₹25,000 monthly SIP, but the market soon crashed by 54%, lasting 19 brutal months. His portfolio was deep in the red.

📈 September 2001: Sameer waited for the market bottom and then started his ₹25,000 SIP.

Both continued investing till December 2024. But when they checked their portfolios, the results were shocking.

Who Made More Money?

| Investor | SIP Start Date | Total Invested | Final Portfolio Value (Dec 2024) |

|---|---|---|---|

| 🟥 Ravi (Started at the Top) | Feb 2000 | ₹74.75 Lakh | ₹6.70 Crore |

| 🟩 Sameer (Started at the Bottom) | Sep 2001 | ₹70 Lakh | ₹5.50 Crore |

💡 Surprised? Ravi made ₹1.2 Crore MORE than Sameer, despite investing just ₹4.75 Lakh extra! But how?

Why Did Starting at the Top Work Better?

Most people believe that investing at market peaks is risky, but data tells a different story.

✅ SIPs Buy More Units When Markets Fall

When the market crashes, your SIP automatically buys more mutual fund units at lower prices. Over time, these extra units generate higher returns.

✅ Compounding Works Best Over the Long Term

By staying invested for 25 years, Ravi’s returns compounded significantly more than Sameer’s.

✅ Timing the Market is a Myth

Even if you start investing at the worst possible time, long-term investing ensures you benefit from market recovery and growth.

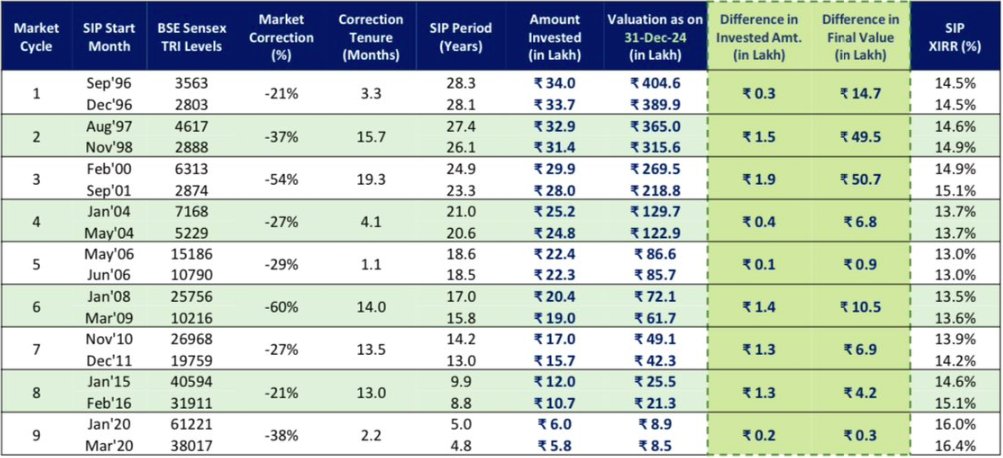

A study by WhiteOak Capital Mutual Fund shows that in the last 28 years, every major market correction has rewarded patient SIP investors.

What Should You Do When the Market Crashes?

The next time the stock market crashes, ask yourself these two important questions:

🔹 Should I stop my SIP?

No! This is when SIPs work the best. Lower prices mean you accumulate more units, boosting future returns.

🔹 Am I a long-term investor?

If you’re investing for financial freedom in 20-25 years, short-term market crashes should not worry you. Patience is the key.

Final Takeaway: The Best SIP Strategy is to Stay Invested

Here’s the biggest lesson from Ravi’s story:

If you can’t time the market, don’t try. Just stay invested.

Market crashes are not the enemy—they are opportunities to build wealth faster.

So, the next time you see your portfolio in red, don’t panic—celebrate! History has shown that SIP investors who stay invested always come out wealthier in the end. 🚀

Want to Build Wealth Without Stress?

Start your SIP today and stay invested for the long term. Your future self will thank you! 😊

Happy Reading & Happy Investing!!!

Viralkumar Shah (Certified Financial Planner CM – USA)

Author – Financial Planning Sahi Hai! – Keep Your Life Organized